All about Medicare Advantage Agent

All about Medicare Advantage Agent

Blog Article

The 4-Minute Rule for Medicare Advantage Agent

Table of Contents10 Easy Facts About Medicare Advantage Agent Shown7 Simple Techniques For Medicare Advantage AgentSome Ideas on Medicare Advantage Agent You Need To Know4 Easy Facts About Medicare Advantage Agent DescribedThe Ultimate Guide To Medicare Advantage AgentThe Of Medicare Advantage Agent

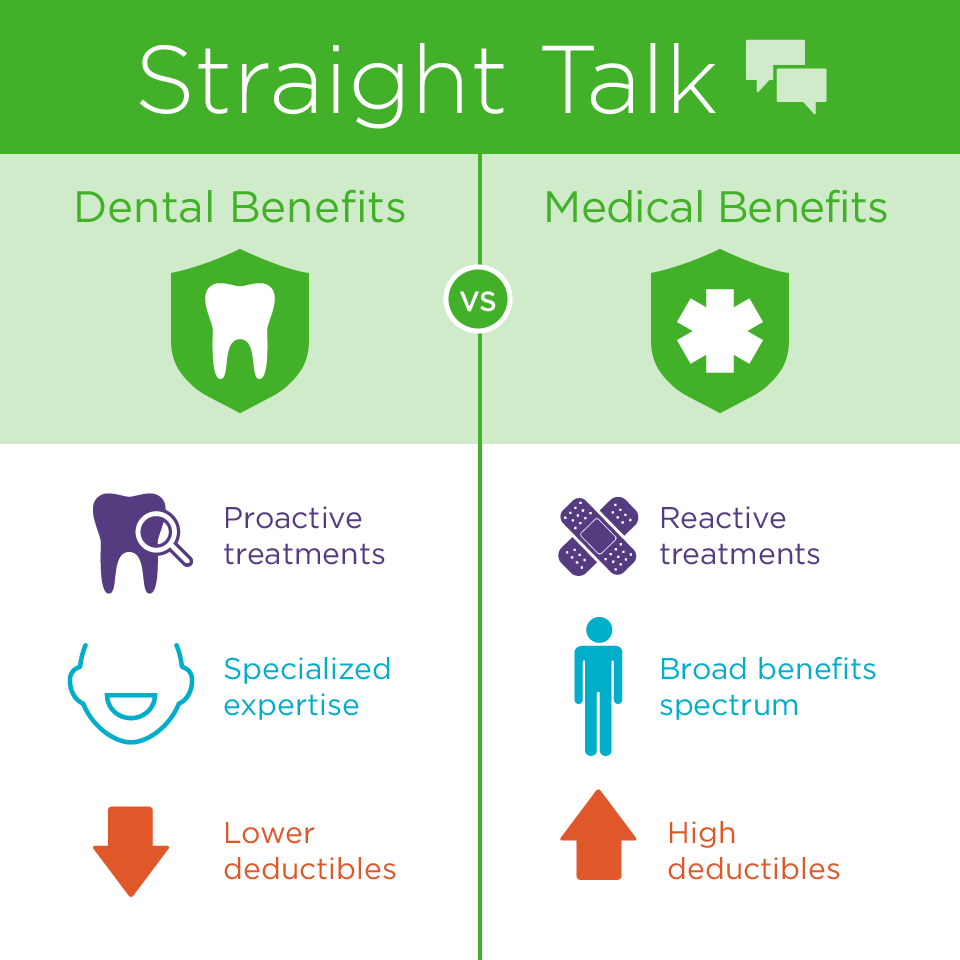

You'll also have a copayment if you most likely to the emergency area or see a specialist. The quantities differ by plan. is a quantity you pay for a covered service after you have actually fulfilled your insurance deductible. It's typically a portion of the cost of the service. As an example, your health insurance plan could pay 80 % of the price of a surgery or health center remain.

A strategy year is the 12-month period from the date your protection started. There are 4 types of major medical health plans in Texas.

Exclusive provider (EPO) strategies. All 4 types are taken care of treatment plans. Taken care of care strategies restrict your choice of medical professionals or motivate you to use medical professionals in their networks.

Medicare Advantage Agent for Beginners

The strategies differ in the degree to which you can make use of doctors outside the network and whether you should have a physician to manage your treatment. If you don't, you might have to pay the full expense of your treatment on your own.

If the anesthesiologist is out of your health plan's network, you will certainly obtain a shock costs. State and government laws shield you from shock clinical costs.

You can use this duration to join the plan if you really did not previously. Strategies with higher deductibles, copayments, and coinsurance have reduced costs.

The Buzz on Medicare Advantage Agent

Call the industry for more details. If you get from an unlicensed insurance company, your claim can go unpaid if the business goes broke. Call our Help Line or see our internet site to inspect whether a firm or representative has a certificate. Know what each plan covers. If you have doctors you intend to keep, make certain they're in the plan's network.

Make certain your medications are on the strategy's checklist of accepted drugs. A plan will not pay for drugs that aren't on its checklist.

The Texas Life and Health Insurance coverage Guaranty Association pays cases for health and wellness insurance coverage. It does not pay insurance claims for HMOs and some various other types of plans.

Your spouse and youngsters likewise can proceed their coverage if you take place Medicare, you and your spouse separation, or you pass away. They have to have been on your strategy for one year or be younger than 1 year old. Their protection over at this website will certainly finish if they get various other coverage, don't pay the premiums, or your company quits using medical insurance.

The smart Trick of Medicare Advantage Agent That Nobody is Discussing

You need to tell your company in composing that you want it. If you proceed your insurance coverage under COBRA, you should pay the costs yourself. Your company doesn't have to pay any one of your premiums. Your COBRA coverage will coincide as the coverage you had with your employer's plan.

State extension lets you maintain your insurance coverage even if you can't obtain COBRA. If you aren't qualified for COBRA, you can continue your coverage with state extension for 9 months you can look here after your task finishes (Medicare Advantage Agent). To get state continuation, you should have had insurance coverage for the three months before your work finished

If you have a health insurance via your company, the employer will certainly have details on your plan. Read your certification, and maintain it useful to take a look at when you use wellness services. Be certain you recognize specifically what your strategy covers. Not all health and wellness prepares cover the exact same services in the exact same way.

All About Medicare Advantage Agent

It will certainly additionally tell you if any solutions have constraints (such as maximum amount that the health insurance plan will spend for durable medical devices or physical therapy). And it needs to tell what services are not covered whatsoever (such as acupuncture). Do your research, research study all the options available, and review your insurance policy prior to making any decisions.

It should tell you if you need to have the health insurance plan accredit care prior to you see a company. It must also tell you: If you need to have the strategy accredit treatment before you see a provider What to do in instance of an emergency situation What to do if you are hospitalized Keep in mind, the health insurance might not pay for your solutions if you do not comply with the right procedures.

When you have a medical procedure or see, you normally pay your healthcare supplier (medical professional, medical facility, specialist, etc) a co-pay, co-insurance, and/or a deductible to cover your part of the service provider's costs. Medicare Advantage Agent. You expect your health plan to pay the remainder of the expense if you are seeing an in-network supplier

Medicare Advantage Agent - Questions

However, there are some instances when you could need to submit a claim yourself. This might occur when you go to an out-of-network company, when the provider does not accept your insurance, or when you are taking a trip. If you require to file your own wellness insurance claim, call the number on your insurance coverage card, and the customer support rep can notify you just how to sue.

Numerous health insurance plan have a time frame for the length of time you have to sue, generally within 90 days of read the solution. After you submit the insurance claim, the health insurance has a minimal time (it differs per state) to notify you or your provider if the health insurance has approved or refuted the insurance claim.

If it determines that a solution is not medically essential, the plan may deny or reduce payments. For some health insurance plan, this medical necessity decision is made prior to treatment. For other health insurance plan, the choice is made when the business gets a costs from the supplier. The company will certainly send you a description of benefits that lays out the solution, the amount paid, and any type of extra amount for which you may still be liable.

Report this page